The economic impact of Russia’s 2022 invasion of the country began in February 2022, days after Russia began recognizing and complicating the people of the two breakaway republics. The economic sanctions that followed targeted large parts of the Russian economy, Russian oligarchs, and members of the Russian government.

Russia, in turn, has responded with sanctions. The presence of war and sanctions has had a severe impact on the recovery of the world economy during the global recession of the Covid-19 disease, and as a result of this country’s war, estimates of a 30-year economic regression are predicted for Russia. Stay with Dr.graphic to get more information about the world.

Background

At the beginning of 2014, Russia faced extensive sanctions due to the annexation of Crimea, which hindered the country’s economic growth and development. In 2020, the recession caused by the spread of Covid and the oil price war with Saudi Arabia also affected the Russian economy. Additional sanctions were also imposed on Russia on the eve of the invasion in 2021. The Russian stock market fell 20 percent during the military offensive.

Kristalina Georgieva, head of the International Monetary Fund, warned that the conflict posed significant economic risks regionally and internationally. She added that the International Monetary Fund can help other countries affected by the conflict and a supplementary loan package of 2.2 billion dollars has been prepared to help Ukraine.

World Bank Group President David Malpass said the conflict would have far-reaching economic and social effects, and reported that the bank was preparing options for significant economic and financial support for Ukrainians and other countries in the region.

Despite unprecedented international sanctions against Russia, payment systems related to energy, raw materials, as well as food supplies have been largely spared from these measures due to the potential impact on global food prices. Russia and Ukraine are major producers of wheat, which export it to Mediterranean countries and North Africa through the Bosphorus. The expulsion of some Russian banks from SWIFT is expected to affect the country’s exports. Considering the fact that Russia is the largest trade and economic partner of post-Soviet countries in Central Asia and the main destination of millions of migrant workers from the Commonwealth of Independent States, this issue makes Central Asian countries particularly hard hit by Western sanctions against Russia.

The sanctions also included freezing the assets of Russia’s central bank, which holds $630 billion in foreign currency reserves, to prevent Russia from neutralizing the impact of the sanctions.

On May 5, European Council President Charles Michel said:

“I am absolutely convinced that it is very important not only to freeze assets, but also to be able to confiscate them, to make them available for the reconstruction of Ukraine.”

Impact on markets and the economy

The 2022 attacks and subsequent economic sanctions had a severe impact on the Russian and Ukrainian economies, reducing the supply and supply of products for some global markets.

Cost of food and agricultural products

Wheat prices rose to their highest level since 2008 in response to the 2022 attacks. Ukraine had 10% of the world wheat export share. At the time of the invasion, Ukraine was the fourth largest exporter of corn and wheat and the largest exporter of sunflower oil in the world, Russia and Ukraine together accounted for 27% of wheat exports and 53% of sunflower and its seeds in the world. The head of the World Food Program, David Beasley, warned in March that the war in Ukraine could push the global food crisis to “levels beyond anything we’ve seen before.”

Agreement on export

The United Nations, Russia, Ukraine and Turkey signed agreements on July 22, 2022 aimed at guaranteeing both countries’ grain exports and Russian fertilizer exports through the Black Sea to compensate for shortages in developing countries. The next day, Russia fired missiles at the port city of Odessa, through which Ukrainian grain was shipped. On September 7, 2022, Putin announced his intention to revise the terms of the grain export agreement.

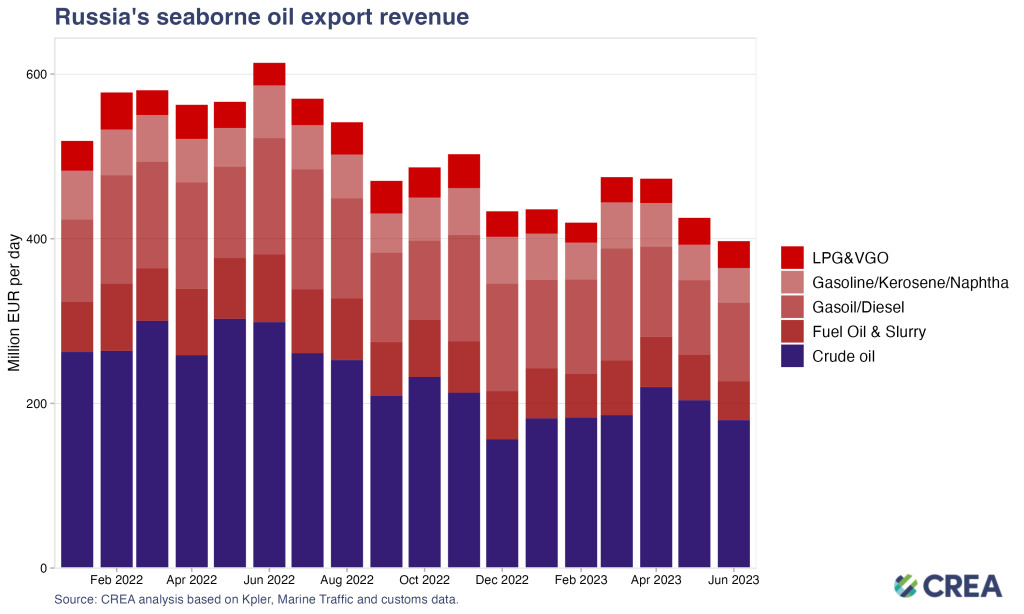

Energy and oil

In January 2022, Russia produced 11.3 million barrels per day of crude oil and gas condensate, of which 10 million barrels were crude oil. This would make Russia the world’s third-largest oil producer behind the United States and Saudi Arabia (they produced 17.6 million barrels per day and 12 million barrels per day, respectively, during the same period).

However, Russia is the largest exporter of petroleum products to world markets and the second largest exporter of crude oil after Saudi Arabia. In December 2021, Russia exported 7.8 million barrels per day, including 5 million barrels of crude oil.

In the first two weeks of the war, global oil prices rose by $8 a barrel, pushing Brent above $100 a barrel for the first time since 2014. On February 27, BP, one of the world’s seven largest oil and gas companies and the only major foreign investor in Russia, announced that it would sell its 19.75% stake in Rosneft. Rosneft’s interests accounted for about half of BP’s oil and gas reserves and a third of its production. The divestment could cost the company as much as $25 billion, and analysts noted that BP was unlikely to recover a fraction of that cost. On the same day, Norway’s sovereign wealth fund, the world’s largest sovereign wealth fund, announced it would freeze investments in Russia and divest Russian assets. Before the invasion, the fund held about NOK 25 billion ($2.83 billion) in shares of Russian companies and Russian government bonds.

On February 28, as a result of the invasion, the Canadian government announced a ban on Russian crude oil imports into Canada. According to the Canadian government, it was not importing crude oil from Russia at the time the ban was announced.

Before the sanctions, about 60% of Russian oil exports went to European countries that are members of the Economic Cooperation and Development Organization. By November 2021, Russia accounts for 34% of Europe’s oil imports. Energy consultancy Specs estimated that up to 70 percent of Russian crude was “struggling to find buyers” as Europe’s normal export market sought crude from the Middle East instead. While sanctions and the toxicity of trade with Russia were major risk factors, another difficulty was the wartime situation in the Black Sea. This led to major shipping companies mandating war insurance for tankers sailing from Novorossiysk, Russia’s main oil export terminal. Insurance problems also affected Kazakhstan crude, which uses Novorossiysk for its Tengiz field.

Until November 2021, Russian oil accounted for 17% of the total imports in the American countries that are members of the Organization for Economic Cooperation and Development (625 thousand barrels per day).

On March 8, US President Joe Biden announced a ban on oil imports from Russia, telling reporters:

“We are banning Russian oil and gas imports. This means that Russian oil will no longer be acceptable in US ports, and the American people will deal another powerful blow to Putin’s war machine.

German Minister of Economic Affairs Robert Habeck warned:

“If we don’t get more gas next winter, and if gas from Russia is cut off, we probably won’t have enough gas to heat all our homes and keep all our industries going.”

In the first three months after the invasion of Ukraine, Russia earned $24 billion from energy sales to China and India. About 20% of Russian oil exports went to China, the only major buyer of Russian oil until November 2021. That year, China bought an average of 1.6 million barrels of crude oil per day from Russia. Five percent of the total oil imports of the Asia-Pacific region, a member of the Organization for Economic Cooperation and Development, came from Russia (440,000 barrels per day).

In June 2022, Russia became China’s largest oil supplier, and Russia supplied more than half of China’s oil imports. Russia has also historically been a significant exporter of crude oil to former Soviet and Eastern Bloc countries, including Ukraine, Belarus, Romania, and Bulgaria.

While many Western countries imposed sanctions on Russian energy companies, Saudi Arabia’s Kingdom Holding Company secretly invested more than $500 million in three major Russian energy companies between February and March 2022. In February, the investment firm invested $365 million and $52 million in Gazprom and Rosneft’s global depositary receipts, respectively. Then, between February and March, the company invested $109 million in Lukoil depositary receipts in the United States. Kingdom Holding Company is led by billionaire Prince Waleed bin Talal, and 16.9% of its shares belong to the Saudi Arabian sovereign wealth fund headed by Mohammed bin Salman.

You also might like to read:

Which countries have the fastest internet speed? Rank of Iran

sources: Wikipedia _ NYTIMES

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.